How To Calculate Your Tenant’s Rent to Income Ratio

Brought to you by RentSpree

Housing affordability is a hot topic for policymakers at the municipal, state, and federal levels. For investment property owners, property managers, and rental agents, ensuring that a rental applicant has the income necessary to pay the rent is an important part of the vetting process. Learning how to calculate your tenant’s rent to income ratio is a first step in making sure that they can be relied on to pay their rental payments on time each month.

COVID-19 and late rental payments

One of the ways that state governments attempted to help renters at the start of the COVID-19 pandemic was by putting a moratorium on evictions. This was a response, in part, to the projected rise in unemployment caused by pandemic-related company closures and an attempt to avoid widespread housing instability during the most difficult early days of the shutdown.

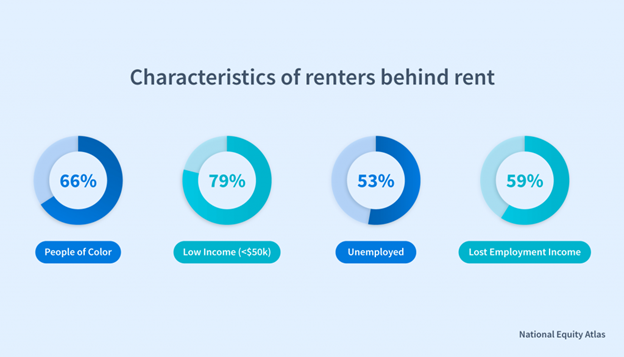

Now, new numbers from the National Equity Atlas, a research partnership between PolicyLink, University of Southern California, and the Right to the City Alliance, show that 14% of all households that rent are behind on payments as of late March 2021. The shortfall amounts to approximately $20 billion in late payments.

While the circumstances leading to these late rental payments are unique, the problem of late rent is not. It’s essential to properly screen potential tenants in order to determine how able they are to pay their rent consistently and in a timely manner. Part of this screening process involves calculating the rent to income ratio to determine how affordable your rental property is for the individual tenant.

Why does rent to income ratio matter?

When looking for a new home, potential tenants often make a wishlist of the ideal neighborhood, fixtures and finishes, number of bedrooms and baths, and community amenities they want in their new home. Unfortunately, they may not always focus closely on their budget or they may be convinced that they’ll tighten their belt and cut expenses in order to afford a nicer place to live.

Life is not predictable and expenses arise that can’t always be planned for. Part of the logic of evaluating the rent to income ratio during the rental application process is to make sure that the cost of the tenant’s housing makes sense in relation to their current income. That helps to keep renters from overextending themselves and entering into a rental agreement that they, ultimately, can’t afford to maintain for the length of their rental agreement.

Whether you are an individual landlord or a rental agent, you know that vacancies are a drain on your budget. You may be worried about filling a property, choosing to overlook weak financials in order to put someone in place and hoping for the best. After all, if the renter gets in over his or her head, that’s their lookout, right?

This kind of thinking is shortsighted since it will ultimately cost you far more to struggle with, evict, and replace an improperly screened tenant than to wait for the right renter in the first place. Make sure that you do your due diligence so that the renter you put in place will be a perfect fit.

How does rent to income ratio fit into your overall financial review?

For a landlord or rental agent, rent to income ratio is just one part of an overall picture that you need to develop in order to properly evaluate your potential tenant. Other financial metrics you’ll want to consider include credit score and credit history as well as debt-to-income ratio.

In addition, you’ll need to look at other factors to properly evaluate the potential renter. These include employment history, rental history, and criminal record. You’ll also want to consider references that are provided and take into account lifestyle factors like pet ownership, smoking, and other requirements for the property, like lawn care.

It’s important for you to develop and implement a consistent screening process for all of your applicants in order to avoid charges of preferential treatment or discrimination. Knowledge of and compliance with fair housing rules and regulations for your market is easier when you have a well-defined screening process in place.

Calculating the rent to income ratio

There are two different ways to calculate the rent to income ratio depending on where you are in the tenant approval process. One is based on the property itself and the rent you’d like to charge. The other is based on the gross income of a renter who is applying for a lease on your property.

Scenario #1: Property-Based Calculation

You have analyzed a rental property’s potential to determine the rent you can charge based on the property’s features and your local market. Based on this, you decide that you can charge $1500 per month for rent.

In order to estimate what your ideal tenant’s gross monthly income will be, multiply the rent you’re planning to charge times three to get a rough idea of the correct ratio.

Example: $2000 rent * 3 = $6000 gross monthly income or $72,000 gross annual income

Now, when you are reviewing a rental application, you can tell at a glance whether your potential tenant is in the correct ballpark financially for approval.

Scenario #2: Income-Based Calculation

Another way to calculate the rent to income ratio is to start with an applicant’s income and determine how much rent he or she can afford. In order to do this, you’ll multiply the tenant’s monthly income by 30% or .30.

Example: $4500 gross monthly income * .3 = $1350 rental payment

This allows you to work with a potential tenant to find a property that is affordable. This can be a smart way to calculate rent to income if you are managing a number of properties at a variety of price points since it allows you to help applicants find properties that fit their budgets.

What is a good rent to income ratio?

Overall, the figure of 30% rent as a percentage of income is considered a good standard to shoot for, and indeed it appears to be about the right percentage on average, according to census data. Much of the “ideal” rent to income ratio is dependent on where you live since major metropolitan areas may see much higher ratios, sometimes as much as 50%.

Remember that rent to income ratio is a single criterion to consider when screening potential tenants. An applicant with a 35% rent to income ratio and a stellar record of on-time rent payments from a past landlord is certainly preferable to one with a 25% ratio who is habitually late with the rent or has a credit history filled with late payments.

In the event that a renter’s rent to income ratio is higher than you would prefer, you have options for helping them to qualify for the property. These could include the following:

- Ask for an increased security deposit to help your renter keep additional funds in escrow in the event of non-payment.

- Charge the monthly pet rent as an up-front pet deposit, reducing the rent due month to month.

- Ask for a co-signer on the lease and use their income as additional consideration for the renter’s ratio

Remember to make your decisions based on a well-defined screening process. If you would offer an alternative arrangement to one rental applicant, you will need to offer that same alternative to all applicants in order to ensure a fair application and screening process.

What types of income should you count?

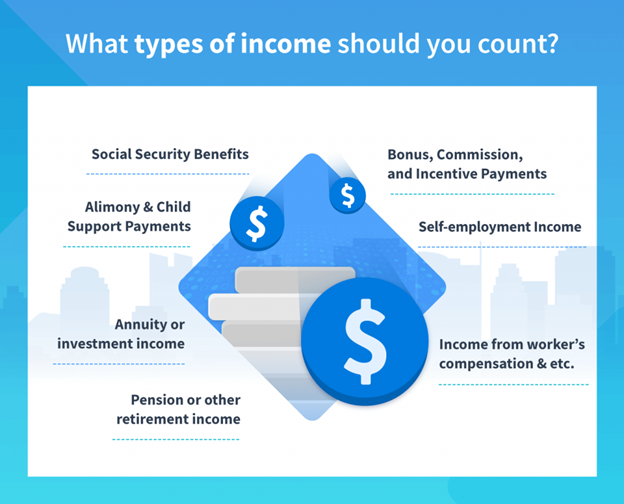

Payroll can be verified through bank statements reflecting direct deposits, paycheck stubs, W-2 statements, tax records, or a verification of employment letter from the employer which includes salary information. Beyond that, there are a variety of types of income to take into account as you verify income for your rental applicant. When considering a tenant’s income, don’t forget to look for the following:

- Social Security Benefits:These can be verified through an award letter from the Social Security Administration or by checking bank statements.

- Alimony and Child Support Payments:These funds can be verified through a court-ordered award letter.

- Annuity or investment income:You should be able to verify dividends and payments from investment accounts through a statement from the brokerage. Be sure and verify the expiration of payments to see if they will continue for the foreseeable future.

- Pension or other retirement income:Verify pension or retirement income through a pension statement or through bank statements.

- Bonus, Commission, and Incentive Payments:Applicants should be able to provide proof of income from these sources but you may want to see more than two or three months of overall income in order to determine how steady their income is over time.

- Self-employment Income:Freelancers and contractors may have income from a variety of sources. It may be a good idea to check several months’ worth of bank statements to ensure that they have steady income throughout the year.

- Income from worker’s compensation, insurance compensation, severance pay, or court-awarded compensation:These can be verified through documentation from the court or company making the payment.

While you can use any or all of these types of income to count toward your applicant’s income, you’ll want to consider how reliable this income is in terms of long-term compensation. For example, while Social Security or pension benefits would be the same month after month, severance pay or a bonus payment may constitute a one-time influx of cash. You’ll need to look for ongoing income rather than limiting yourself to an income assessment based on a single, non-repeatable event.

How can you encourage on-time rent payments?

Once you have approved and onboarded a renter, there are a variety of strategies that you can use to encourage on-time rent payments. Consider the following options:

- Streamline the rent payment process with an automatic payment option and monthly reminders sent to your renter’s email or phone. When rent payments are automated, they become non-negotiables and lead to greater consistency.

- Send out additional reminders as needed, especially if the first of the month falls on a weekend or holiday. Let tenants know where and how they can pay their rent to ensure that it is recorded as an on-time payment.

- Make sure that your expectations regarding rent payments are clear to tenants both during onboarding and throughout the rental term. Provide a tenant handbook, maintain a website with frequently asked questions, or maintain an online library of information in written or video form so that tenants can refer to it on a regular basis.

- Communicate and enforce late fees when rent is not paid on time. When tenants are aware that you are serious about their on-time obligations, they will become more serious about them as well.

- Consider offering incentives such as rent discounts or credit bureau reporting to encourage on-time rent payment. This positive reinforcement can help your tenants to see the upside of their on-time payment and take it more seriously.

Aside from these strategies, remember that communication is an essential part of staying in the loop with renters. If a tenant loses his or her job or experiences a significant financial hardship, you are better off keeping the lines of communication open so that they feel able to come and talk to you rather than avoiding you and falling behind on their rent payments.

Spending too much time evaluating the financial data for your rental applicants? RentSpree can help. We offer a wide variety of services and resources designed to help simplify every aspect of the rental application and tenant evaluation process, including the financial tools you need to make better decisions like our rent to income ratio calculator.

RentSpree is the preferred, online tenant screening provider of the Apartment Association of Greater Los Angeles. With it, you can put together a completed application package in one simple step. This includes a completed rental application, credit report and score, criminal background check, and national eviction history. RentSpree can handle the entire screening process for you and it takes just two minutes to start screening! Better yet, you can receive all reports back instantly at the property or at another time of your choosing. Visit https://aagla.rentspree.com to learn more.

RentSpree is the preferred, online tenant screening provider of the Apartment Association of Greater Los Angeles. With it, you can put together a completed application package in one simple step. This includes a completed rental application, credit report and score, criminal background check, and national eviction history. RentSpree can handle the entire screening process for you and it takes just two minutes to start screening! Better yet, you can receive all reports back instantly at the property or at another time of your choosing. Visit https://aagla.rentspree.com to learn more.