RealtyTrac® Report: Single-Family Rental Properties in Nearly Half of U.S. Counties at Risk for Incr

A new report by RealtyTrac, which measures relative risk among property owners due to the impacts of the pandemic, shows that single-family rental property owners in 48% of all U.S. counties are at above-average risk for default. Almost 90% of properties surveyed are owned by small business, “mom-and-pop” owners who own fewer than 10 properties. The financial impacts of COVID-19, resulting job losses, and government-imposed eviction moratoria have resulted in reduced rental payments which, in turn, lead to potential default among these smaller investors, many of whom are highly leveraged based on loan-to-value (LTV) ratio data. According to RealtyTrac’s research, the average risk score among the country’s 3,143 counties is 50.2, with 1,514, or 48%, at above-average risk.

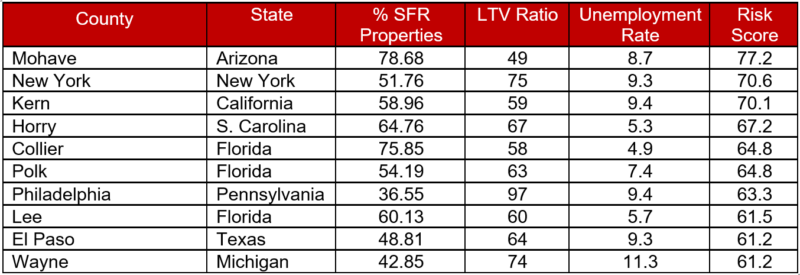

For the largest 100 counties – based on the total number of properties – the average risk score is 43.6, with 53% at above-average risk. Among these large counties, Florida, New York, and California counties accounted for 44% of the 25 most at-risk counties. New York (Erie, Kings, Monroe, and New York Counties) and Florida (Collier, Lee, Polk, and Marion) each had four counties in the top 25 ranking, and California (Kern, Riverside, and San Bernardino) had three. Mohave County in Arizona was rated as the most at-risk of the 100 largest counties in the country.

Of the 100 largest counties with higher-than-average risk scores, those located in six states accounted for 27%: Florida (7), New York (5), California (4), Ohio (4), Texas (4) and Illinois (3). Four states had two counties each with above-average risk scores – Arizona, Connecticut, Maryland, and Michigan. No other state had more than one of the 100 largest counties with an above-average risk score. The average unemployment rate for all the 100 largest counties with above-average risk scores was almost a full point higher than the national average (7.62%). But while unemployment rates were one of the three criteria used to assess risk, there was not always a direct correlation between a state’s unemployment rate and above-average risk scores. While California (9.0%) and New York (8.2%) had two of the highest unemployment rates in the country, Florida, which had the highest number of at-risk counties among the 100 largest, had an unemployment rate below the national average (6.1% vs. 6.7%), as did Ohio (5.5%).