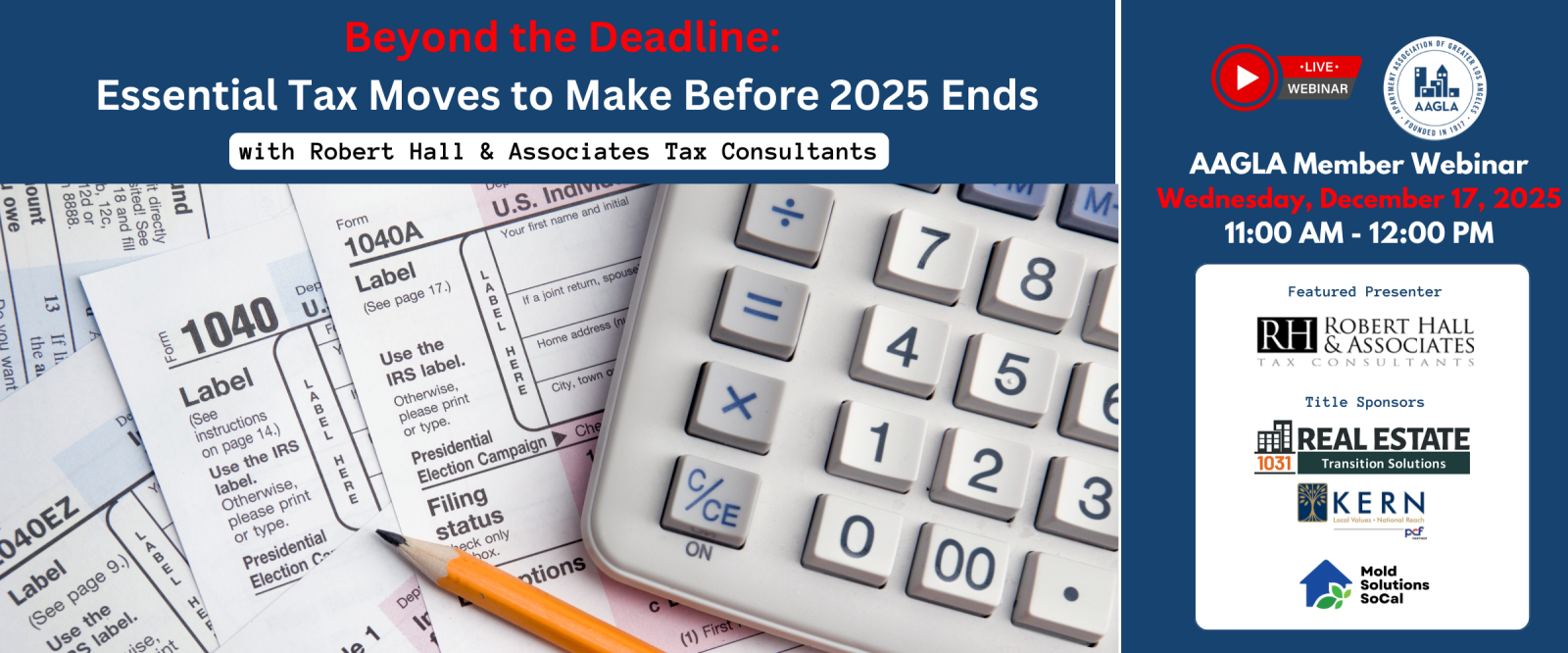

Beyond the Deadline: Essential Tax Moves to Make Before 2025 Ends

Beyond the Deadline: Essential Tax Moves to Make Before 2025 Ends

Tax Update: Featuring Insights on the Newly Passed “Big Beautiful Bill” Tax Changes

Date / Time: Wednesday, December 17, 2025, from 11:00 a.m. – 12:00 p.m.

How to Attend: Logged In Users Can Register Using the “Register Now” Button.

A sweeping new tax law — known as “The Big Beautiful Bill” — has officially been signed into law, bringing with it 10 major changes that are set to reshape the tax landscape for individuals, families, and businesses alike. This webinar will walk you through the key updates — from expanded deductions to sunset clauses and planning strategies — and how they could affect your income, estate planning, and real estate investments.

With 2025 winding down and sweeping new tax legislation reshaping the landscape, now is the time to take proactive steps to secure your financial future and maximize your tax savings before key provisions take effect. Join us for an insightful webinar led by Nicole Green, a tax advisor from Robert Hall & Associates, where we’ll walk you through strategies that combine timeless year-end planning with the latest updates from the new tax bill. Learn how to adapt to the evolving tax code and position yourself for success in 2026 and beyond.

Whether you’re a realtor, real estate investor, or an everyday taxpayer, these changes may significantly shift your tax outlook in 2025 and beyond. Join Tony Watson, Tax Advisor at Robert Hall & Associates, as he unpacks how these updates can impact your portfolio, clients, and bottom line. This is a must-attend session for those looking to stay ahead of the curve — and make informed decisions before key provisions begin to phase out.

During this webinar, we will cover:

Year-End Tax Strategies Under the New Law: Why reviewing your tax situation before December 31st is more important than ever for optimizing your tax position.

- The Top 10 Changes That Could Affect Your Wallet: A breakdown of the most significant updates from the “Big Beautiful Bill” and how they may impact individuals, families, and business owners.

- W-4 Withholding Optimization: Fine-tune your withholdings to stay compliant with the latest IRS updates and avoid year-end surprises.

- Mortgage Interest Deductibility: How new thresholds and limitations could affect your home or investment property deductions.

- Estimated Tax Payments: How to plan ahead under the new tax brackets and deduction rules to manage your cash flow and avoid penalties.

- Retirement Planning Adjustments: 401(k)/IRA vs. Self-Directed IRA/Solo 401(k) — which is most advantageous under the new legislation?

- Your Q&A will help to lead the discussion.

Don’t miss this opportunity to gain clarity on how the new bill affects your income, investments, and future tax strategy, so you can make confident, informed moves before the year closes.

WARNING: THE INFORMATION PROVIDED DURING THIS WEBINAR IS FOR GENERAL INFORMATION PURPOSES ONLY. ABSOLUTELY NO LEGAL OR TAX ADVICE IS BEING GIVEN DURING THIS WEBINAR. BEAR IN MIND THAT EVERY SITUATION IS UNIQUE, AND THE LAWS, RULES AND REGULATIONS ARE SUBJECT TO CHANGE AT ANY TIME. SO, BEFORE ACTING, BE SURE TO OBTAIN TAX AND/OR LEGAL ADVICE FROM YOUR LICENSED PROFESSIONAL.

Panelist:

Nicole Green, EA, Senior Tax Consultant & Public Speaker, Robert Hall & Associates

After graduating with a Bachelor’s Degree with a focus in Education, Nicole went on to earn her Master’s Degree in Education and Educational Theory. Her love for learning led her into the tax industry. With the ever-evolving tax code and continual education, it was a perfect match for her.

With almost a decade of experience in the tax world, Nicole Green holds a federal license as an Enrolled Agent tax practitioner, where she can advise, represent, and prepare tax returns for individuals, partnerships, corporations, and any other entity with tax-reporting requirements. Her knowledge in tax has been recognized in numerous publications, including The Wall Street Journal, HomeLight—an online real estate company that matches clients with local agents and provides home loans—and impact.com, a platform that helps influencers and content creators manage partnerships. Nicole has been featured in these outlets for her insightful tax advice and industry knowledge.

Outside the office, Nicole is an avid traveler. She’s been to all 7 continents spanning 50 different countries. She enjoys cooking and trying new cuisines at food festivals around the world. Some of her other favorite activities include attending sporting events and the occasional shopping spree.

Moderator:

Daniel Yukelson, AAGLA Executive Director

Daniel Yukelson is currently the Executive Director of The Apartment Association of Greater Los Angeles (AAGLA). As Certified Public Accountant, Yukelson began his career at Ernst & Young, the global accounting firm, and since then had served in senior financial roles principally as Chief Financial Officer for various public, private and start-up companies. Prior to joining AAGLA, Yukelson served for 12 years as Chief Financial Officer for Premiere Radio Networks, now a subsidiary of I-Heart Media, and then 3 years as Chief Financial Officer for Oasis West Realty, the owner of the Beverly Hilton and Waldorf Astoria Beverly Hills where he was involved with the development and construction of the Waldorf. Yukelson also served for 6 years as a Planning Commissioner and for 3 years as a Public Works Commissioner for the City of Beverly Hills.

A Featured Presentation by:

Robert Hall & Associates

In 1971 Robert Hall had a dream to create an accounting firm that offered the businesses and residents of Los Angeles, high-quality tax services. He recognized that each business is unique and the traditional “cookie-cutter” tax preparation approach was not serving their best interests. Out of this desire to better serve the accounting and tax preparation needs of Californian businesses and individuals, Robert Hall & Associates was born.

In the beginning, Robert Hall started preparing fellow teacher’s taxes out of his garage. As demand for his services grew, the accounting firm expanded to include more talented tax preparers with experience in a variety of industries. Today, Robert Hall still diligently works to prepare taxes and personally trains each tax consultant to achieve a higher standard of quality. Because of his tireless efforts, the Los Angeles accounting firm has grown to become an industry leader that prepares roughly 10,000 tax returns annually. Robert Hall & Associates has grown to not only provide accounting services to Los Angeles, but also to Orange County and the San Fernando Valley and other areas within California. It offers accounting and tax services to a variety of industries, such as: real estate, small business, entertainment, healthcare, law enforcement/firefighters, and education.

Title Sponsor:

Real Estate Transition Solutions

Real Estate Transition Solutions (RETS) is a consulting firm specializing in tax-deferred 1031 Exchange strategies and Delaware Statutory Trust investment property. For over 26 years, we have helped investment property owners perform successful 1031 Exchanges by developing and implementing well-planned, tax-efficient transition plans carefully designed to meet their objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire process, including help selecting and acquiring passive management replacement properties best suited to meet your objectives. To learn more about 1031 Exchanges and Real Estate Transition Solutions, visit www.re-transition.com/aagla or call us at (866) 352-3354.

Title Sponsor:

Kern Insurance Associates

Kern Insurance Associates is a premier brokerage specializing in property and casualty insurance, dedicated to providing robust insurance solutions for property owners, investors, and management firms. With decades of experience, Kern Insurance has developed a deep understanding of the unique challenges faced by property owners in today’s complex insurance landscape. We’ve worked diligently to cultivate an exclusive insurance program designed specifically for property owners, offering tailored coverage options that meet the needs of even the most hard-to-insure properties, particularly in California’s challenging market.

Our mission is to provide comprehensive, competitive insurance solutions that protect our clients' assets, mitigate risks, and promote long-term financial stability. We leverage strong relationships with top insurance carriers and use data-driven insights to negotiate favorable terms and rates. At Kern Insurance, we pride ourselves on going above and beyond for our clients, ensuring that every property is adequately protected, and we remain a step ahead of the ever-evolving market trends. For more information, call (844) 444-KERN (5376) or go to https://kern.com/.

Presenting Sponsor:

Mold Solutions SoCal

The team at MOLD SOLUTIONS SOCAL, servicing Los Angeles, are trusted experts for comprehensive mold remediation and testing services. As professional mold removal experts, they offer a full range of services including mold inspection, mold testing, mold mitigation, and mold cleanup. Their patented Dry Fogging process by Pure Maintenance safely treats mold, often without the need for demolition, ensuring the safety and health of your property. MOLD SOLUTIONS SOCAL provides emergency mold removal, black mold removal, and mold abatement, utilizing advanced mold detection, assessment, and air testing techniques. The dedicated team of mold experts at MOLD SOLUTIONS SOCAL is here to offer reliable mold remediation services. For more information, call Mold Solutions SoCal at (866) 837-2004 or email info@moldsolutionssocal.com, or go to their website at https://www.moldsolutionssocal.com/.